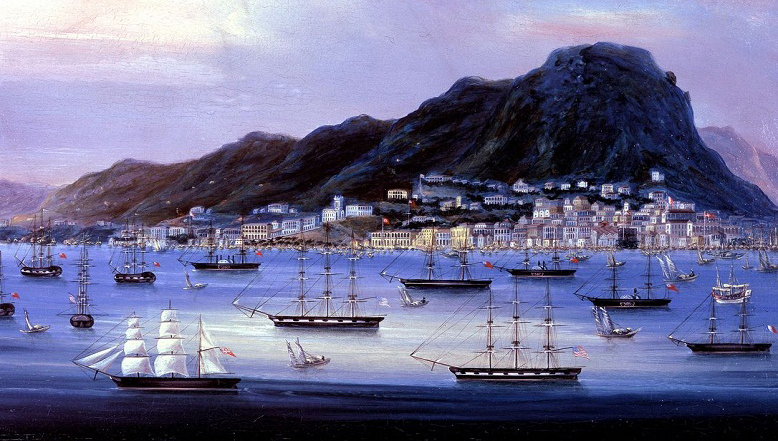

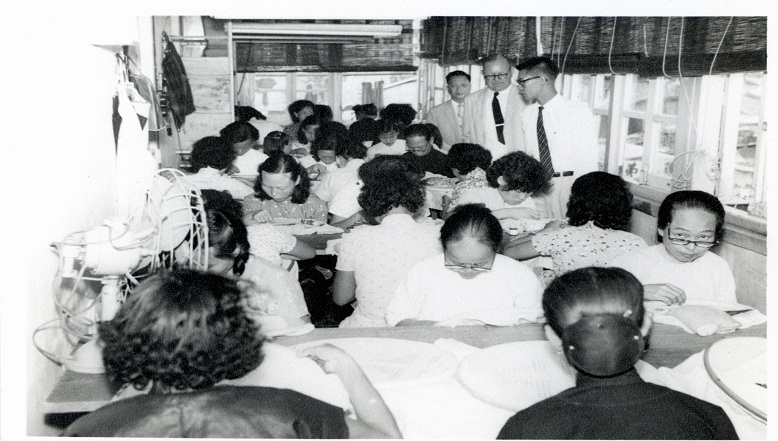

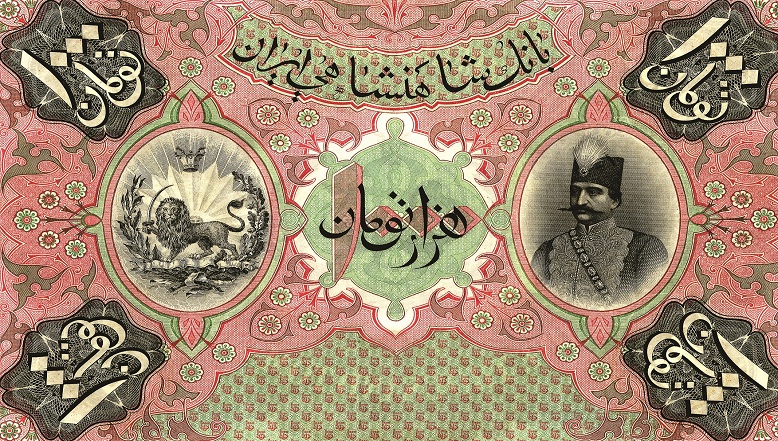

The Hongkong and Shanghai Banking Corporation Limited opened in Hong Kong on 3 March 1865 and in Shanghai one month later. It was the first locally owned bank to operate according to Scottish banking principles.

HSBC in Belgium

Our services

HSBC Continental Europe, through its branch in Brussels, primarily focuses on corporate banking services:

- Corporate Credit and Lending: providing financial support to businesses through various credit and lending solutions.

- Global Trade Solutions: solutions to help manage trade flows and receivables.

- Global Payments Solutions: efficient payment solutions for businesses operating internationally. Services like HSBCnet and SWIFT for Corporates for seamless transactions.

- Capital Markets and Advisory

Our headquarters

Sq. de Meeûs 23

1000 Bruxelles

Belgium

Telephone: +32 2 761 26 70

Our CEO

Jeroen Bakhuizen

Our history in Belgium

- In 1980, Midland Bank (now HSBC UK) opens office in Brussels

- In 1999, HSBC Bank plc opens a branch in Brussels

- In 2021, HSBC Belgium becomes part of HSBC Continental Europe

HSBC in Belgium recognised as Market Leader in Trade Finance 2024

Euromoney’s Trade Finance Survey is among the most comprehensive benchmarking exercises of the world’s banks active in this sector, offering authoritative insight into the needs of clients and their perceptions of the banks they work with. As part of this survey, over 13,000 corporate clients and financial institutions ranked and scored the industry’s leading banks.

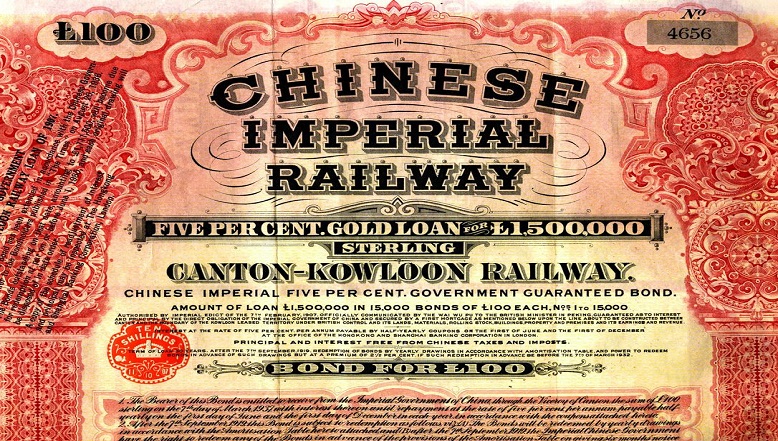

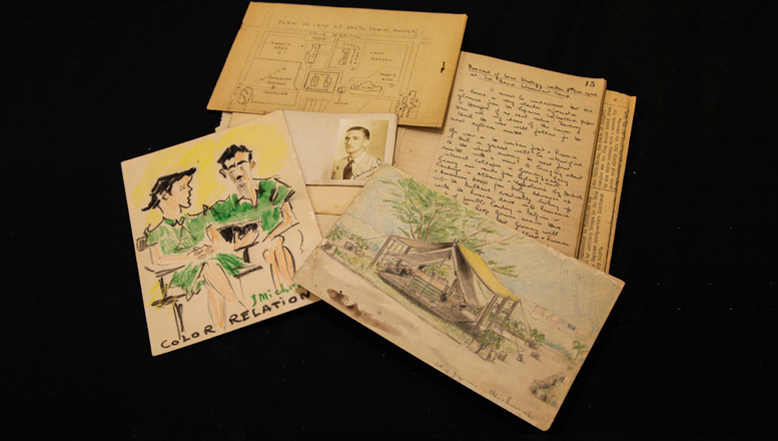

HSBC Group history timeline

It’s difficult to define the value of art Opens in new window

The urge to collect art is driven by very different desires to those behind building a stock or bond portfolio, says Russell Prior.

Making alternatives accessible matters Opens in new window

The democratisation of alternative investments is positive as it will open up opportunities for private wealth investors, says William Benjamin.

New investment solutions needed to finance electricity grids Opens in new window

New investment solutions are needed to upgrade and expand electricity grids at the rate required – for both energy security and the global energy transition, says Randolph Brazier.